The Top Reasons Organizations Hire An External Cfo Include:

Currently undergoing growth such as creating new products or expanding into new markets. Outsourced CFOs might know about similar products, markets, as well as industries, and offer advice on strategy. Outsourced CFOs can help in cost management, risk analysis, and maximising profits. Most likely, an outsourced CFO has overcome similar issues similar to yours and is able to design and implement long-term and sustainable adjustments.

The process of raising equity capital and debt. A CFO outsourced to an Outsourced can assist in raising capital by offering strategies, aiding in due diligence, taking part in meetings for the establishment of expertise, providing advice on the right combination of equity and debt financing, and negotiating term sheets. Maximize margins through analyzing current costs including pricing structures and other factors. Your CFO can help you review your financial statements and suggest changes. Have a look a this outsourced cfo for tips.

Part-Time Consulting And Guidance On Strategy.

Improved or new methods are needed to expand systems to accommodate the growth of businesses and increase complexity. For a replacement or a fresh hire an interim chief financial officer is needed. They could choose to hire an interim CFO who will manage the financial strategy of an organization while they are in search of a full-time one. To consult with an existing CFO or financial team. Although some companies may have an internal CFO, this CFO might not be able solve the issue at hand or meet a goal like the design of a system, capital raising, and so forth. An outsourced CFO can consult with or advise the current CFO on how to improve the performance of their financial team, elevate the overall financial strategy, and transfer valuable skills.

Financial Forecasts.

Forecasts can be utilized to serve a variety of purposes, including forecasting budgets and fundraising. They also help to plan growth and to plan for restructuring. Outsourced CFOs will have extensive knowledge of forecasting and can provide you a detailed forecast based on your long-term goals.

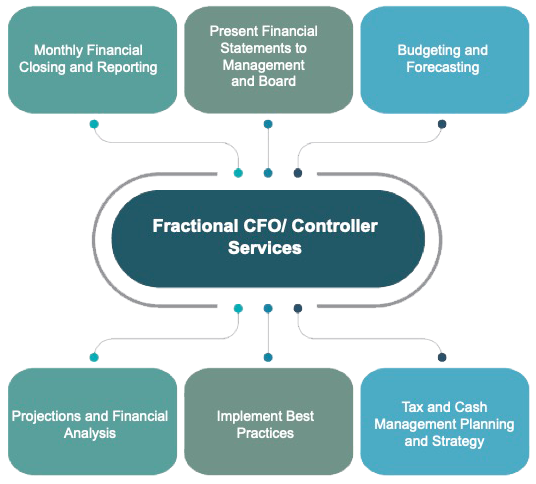

Do I require a Controller, CPA, or CFO?

An CPA or accountant can guarantee compliance with tax laws as well as financial records. An outsourced controller keeps financial records accurate. However, a CFO is accountable for financial strategy, insight planning, execution and strategy which looks ahead to the future. Check out this "outsourced cfo firms" for advice.

Why Would You Choose Outsourcing Your Cfo Rather Than An In-House Cfo?

While every company will benefit from the high-level strategy, operational fine-tuning experience, and contacts of CFOs, not every company is in a position to bring an entire CFO to their team. The hiring of a full-time CFO typically includes a salary per year and benefits. This can be very expensive in the event of annual increases. Many organizations must sacrifice their experience to hire an affordable CFO. A CFO outsourced to another company can increase your profits and make your money "go further" because you're "sharing" the financial responsibility. You only pay for the expertise and time required. Outsourced CFOs with extensive experience are available for an equivalent monthly fee (or less) and without benefits or increases. A partnership with an outsourced CFO can be a viable option. They will have the knowledge and experience to assist you with any issue that might arise. Outsourced CFOs typically have extensive knowledge of the industry and projects. Outsourced CFOs have been in similar companies before and have the expertise to assist you in achieving your objectives. Outsourced CFOs are able to have access to a variety of finance and accounting professionals to help them build long-term or temporary teams that can meet their clients' primary goals. A key benefit of an Outsourced CFO's is their ability create scalable teams with different capabilities and experience in the industry, sometimes at a fraction or even lower than a full-time CFO.